Our humanity depends on Sustainable Development Goal 14 Life Below Water, which aims to “conserve and sustainably use the oceans, seas and marine resources for sustainable development”. Despite this, SDG 14 is the most underfunded of the SDGs.

The blue economy is only as good as the ocean it operates in. Robust impact work drives the success of Ocean 14 Capital’s investments. O14C’s natural capital strategies are as rigorous as its financial ones.

Market-leading returns and embedded impact in every deal.

O14C’s impact strategy is based on a bottom-up view of threats to ocean health and their underlying causes, overlaid with a map of commercial players able to address or influence them. The team’s experience and firm parameters further filter the businesses most profitable and impactful to invest in – late-stage venture and growth stage SMEs.

The team uses science-based metrics to show how investments measurably impact SDG 14.

1. Proprietary Impact Investment Theses

Identify opportunities where commercial, technology, and sustainability drivers converge.

2. Pipeline Development

Filter investments based on fit with proprietary theses, O14C focus areas, and impact.

3. Due Diligence

Analyse qualitative and quantitative SDG14 impact and evaluate ESG performance.

4. Portfolio Management

Engage to enhance value and impact creation, monitor impact, and report to investors.

5. Portfolio Exit

Deploy strategies to maximise ongoing impact post-exit.

O14C believes engagement with challenging sectors is more constructive than exclusion and can offer significant opportunities for improved commercial and ocean impact.

However, O14C will only invest if competitive returns and a high probability of measurable positive, or reduced negative, impact can be achieved.

Sustainable Aquaculture | Sustainable fisheries | Alternatives to fish protein | Circular Plastics | Marine flora/ seaweed |

|

|---|---|---|---|---|---|

| CautionWe always exercise caution where commercial drivers are misaligned with sustainability drivers, or where marginal impact is created. | High tropic-level species such as tuna. Preventative use of antibiotics. | There is a risk of modern slavery in some fisheries. | CO2 emissions of energy intensive industrial processes. | Novel polymers with long & costly gestation periods. | Introduction of non-native species or displacement of sensitive habitats. Untested geo-engineering. |

| No go zonesWe will only make investments that fully comply with, and where possible exceed, all relevant legal and regulatory requirements. | High negative impact fish farming where potential for achieving change is constrained. | Intrinsically harmful practices – shark finning, marine mammals, cyanide. | Terrestrial micro-algae cultivation without ocean impact (e.g algal biofuels, textiles). | Plastic waste processing without current or future ocean impact. Non-ocean degradable/compostable (bio-) plastics. | Unsustainable harvesting of wild seaweeds. |

The ocean provides

200m people are directly or indirectly employed by the marine fishing industry

3bn+ people rely on oceans as their primary source of animal protein

Our vision

A healthy ocean for everyone through a sustainable and regenerative blue economy.

Our mission

To partner with and build value in companies that will have the greatest impact in the blue economy and regenerate natural capital and biodiversity.

To drive investments in SDG14 by backing new technologies and optimising industries that are responding to changing consumer behaviour, value chain pressure and technological advances.

Our values

Collaborative

Bold

Innovative

Respectful

Accountable

The 17 Sustainable Development Goals established by the United Nations in 2015 aim to provide prosperity while protecting the planet.

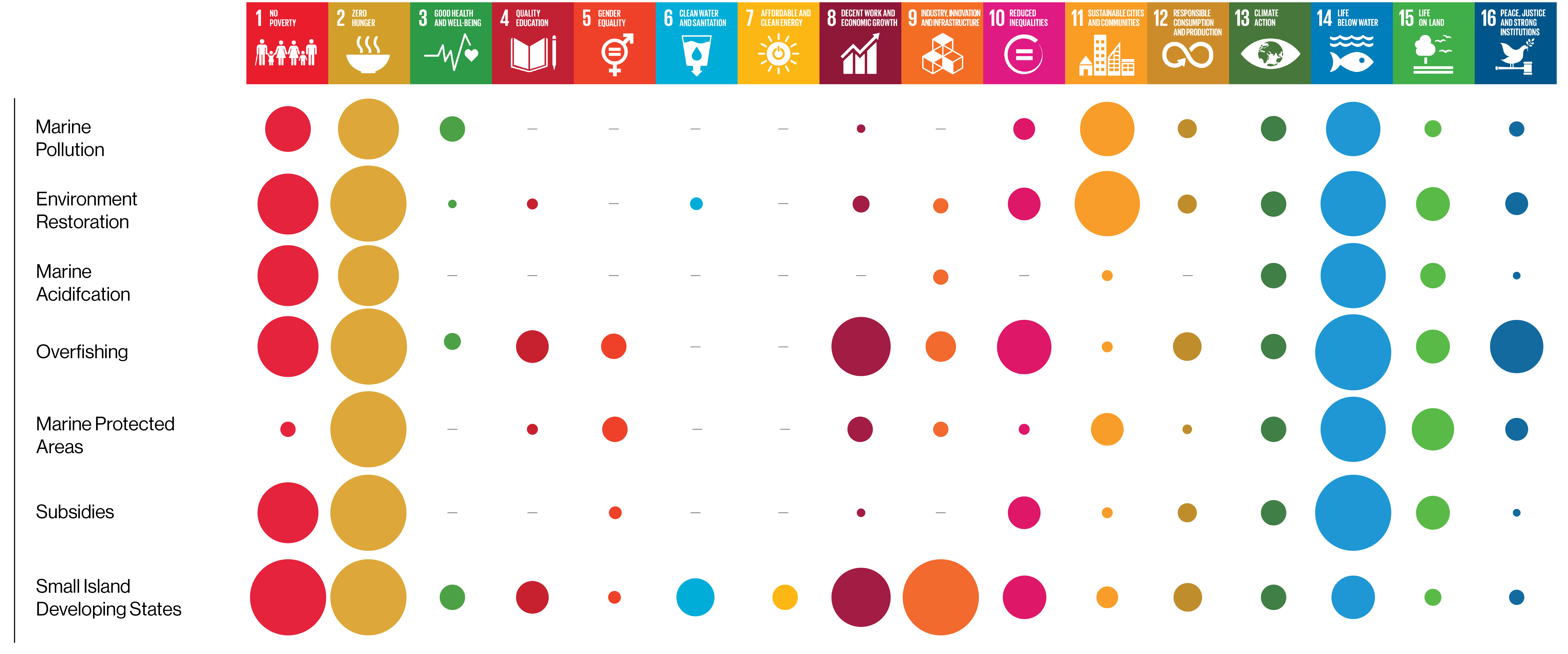

Since their publication, it has become apparent that long-term societal and economic goals cannot be achieved without the foundation of a stable and healthy biosphere. The ocean – covering 70% of our planet, driving weather systems, and modulating climate – is a critical part of that foundation. SDG14 must be addressed now to achieve the other Goals.

Co-benefits of achieving targets for Sustainable Development Goal 14: Life Below Water